"If we went into the funeral business, people would stop dying."— Martin Shugrue, onetime vice chairman of Pan Am

“If a capitalist had been present at Kitty Hawk back in the early 1900s he should’ve shot Orville Wright; he would have saved his progeny money." - Warren Buffet

At the behest of Jet Airways going defunct and the previous issues of Kingfisher and money guzzling saga of Air India, I decided to pen down my thoughts on Airline industry in India and what ails them.

Source: (Link)

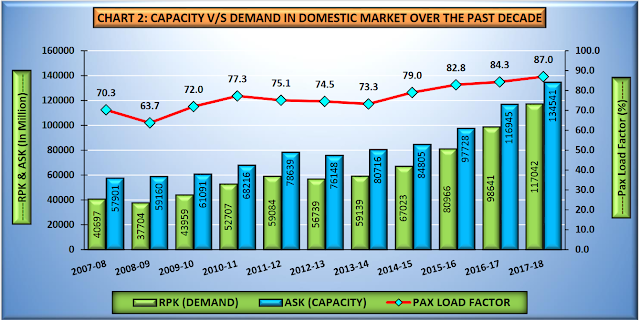

If we take a look at the chart, we come to know that the airline traffic has been on consistent rise as per DGCA data. Further Revenue passenger kilometer (RPK) & Available seat kilometer (ASK) rose persistently and hence the load factor improved from 70% to 83%.

Source: (Link)

To understand RPK & ASK, we will take an example. Say an aircraft flies from Delhi to Mumbai which is ~1500 km. The total seats are 100. However the number of passengers who paid for the flight are 80. So ASK would be 150000(1500*100) and RPK would be 120000(1500*80). Load factor would be 120000/150000 which is ~80%. The market share in terms of RPK is as shown:

Source: (Link)

When we take a detailed view of airline carriers operating cost structure, the following items constitute the bulk of cost:

- Fuel Cost (32%)

- Rental of flight equipment(14%)

- General & Administrative costs (12%)

- Flight Equipment maintenance (10%)

- User Charges (10%)

From these points, we can conclude that most of the costs are fixed in nature (except for fuel). Hence the industry suffers from high Degree of Operating Leverage (DOL) & high Degree of Financial Leverage (DFL).

Degree of Operating Leverage = %Change in EBIT/%Change in Sales

Degree of Financial Leverage = EBIT/(EBIT-Interest)

DOL signifies the sensitivity of operating income with respect to change in sales. The company having high DOL experiences high increase in EBIT with increase in sales. On the other hand, EBIT declines significantly with even a minor decline in sales.

DFL signifies the sensitivity of EPS with the change in Operating income. The company having high DFL experience a lot of fluctuation in its EPS if EBIT swings either way.

Since most of the cost is fixed in nature and due to intense competition in Indian aviation industry, another important highlight which comes in front is price war played between different airlines. To illustrate this point, let us take an example. Say a company operates only 1 aircraft which departs 3 times a day. Now if the departure is increased to 5 times, then the already incurred fixed cost would be spread out. As long as the company is covering the variable expense of the passenger, they can cut the prices to gain more market share (Now you can remember when you heard the news where Vistara was offering the seats at Rs 1200 flat). The profitability of airline company tends to fall with the increase in crude prices. This indicates that airline companies are unable to pass on the extra cost to the customers

Most of the airlines leases the aircraft from the lessor. The lease is mostly operating lease and the lease paid to the lessor is treated as an operating expense on balance sheet. Thus there is no effect on balance sheet. Most of them are taken on the lease from the overseas players (most notably airbus and boeing which are a duopoly). Hence this results in high P&L volatility due to huge foreign exchange exposure.

However as per the new Ind AS 116 standards, most of the lease would be recognized by airline companies in their balance sheet. As a result the balance sheet would become highly leveraged without reducing the foreign exchange exposure risk (Source: Link).

The question which everyone is trying to seek the answer is when would this hemorrhage take a halt. The answer can be found in US air industry which has already witnessed the phase of consolidation and hence the margins are at all time high. Even Warren Buffet who once criticized airline industry, is investing heavily in it (Source: Link).

Given the huge potential and untapped market opportunity, the airline industry would become lucrative once consolidation phase ends (the signs of which has already begun when the void left by Jet Airways was filled by Indigo in no time). Until that time, travelers can enjoy the dirt cheap prices charged by airline companies in India. Investors have to show patience and remain persistent to spot the money making opportunities in Indian airline industry

Comments